Seeking a safe and rewarding way to grow your money? Meet the Public Provident Fund (PPF), a golden opportunity for savvy savers like you. With tax benefits, guaranteed returns, and government backing, the benefits of PPF make it a must-have in your financial toolbox. Whether planning for retirement or building a nest egg, PPF is your ticket to financial peace of mind. Join me, and let’s explore how PPF can put you on the path to financial success!

Table of Contents

- 10 Benefits of PPF (Public Provident Fund)

- 1. Tax Benefits of PPF

- 1.1. Tax Exemption on Contributions to PPF

- 1.2. Tax-free Interest & Maturity Amount

- 1.3. Comparing PPF With Other Tax-saving Instruments

- 2. Long-Term Wealth Creation

- 2.1. Power of Compounding in PPF

- 2.2. Consistent Growth of Investments Over Time

- 2.3. Harnessing PPF for Long-Term Financial Goals

- 3. Guaranteed & Risk-Free Returns

- 3.1. PPF as a Safe Investment Option

- 3.2. Government-Backed Security & stability

- 3.3. Mitigating Risk With Assured Returns

- 4. Retirement Planning With PPF

- 4.1. Building a Retirement Corpus Through PPF

- 4.2. Utilizing PPF as a Long-Term Savings Tool

- 4.3. Factors to Consider for Retirement Planning Using PPF

- 5. Flexibility & Liquidity

- 5.1. Partial Withdrawal Facility From PP

- 5.2. Loan Facility Against PPF Balance

- 5.3. Balancing liquidity Needs With Long-Term Goals

- 6. Financial Discipline & Regular Savings

- 6.1. Cultivating a Savings Habit With PPF

- 6.2. Mandatory Annual Contributions For Account Continuity

- 6.3. Discipline as a Key to Financial Well-being

- 7. Education & Future Planning Benefits of PPF

- 7.1. Utilizing PPF For Children’s Education Expenses

- 7.2. Creating a Financial Safety Net For Future Needs

- 7.3. PPF’s Role in Comprehensive Financial Planning

- 8.1. PPF As Estate Planning Tool

- 8.2. Nominations & Succession Planning For PPF Account

- 8.3. Ensuring Smooth Wealth Transfer To Beneficiaries

- 9. Protection Against Inflation – Protect Benefits of PPF

- 9.1. PPF’s Potential To Combat Inflation

- 9.2. Maintaining Purchasing Power With PPF Investments

- 9.3. Inflation-Adjusted Returns with PPF

- 10.1. Shielding Investments From Market Volatility

- 10.2. Diversification Benefits Of PPF in a Portfolio

- 10.3. Hedging Against Economic Uncertainties

- Conclusion – Benefits of PPF

10 Benefits of PPF (Public Provident Fund)

Are you thinking about saving for the future but needing help figuring out where to start? Let’s look at the benefits of PPF, or Public Provident Fund, your ticket to long-term financial security.

Public Provident Fund offers a secure way to save for the future, while auditing ensures financial transparency and accountability. Together, they underscore the importance of financial prudence and responsibility, fostering a more stable and secure financial landscape.

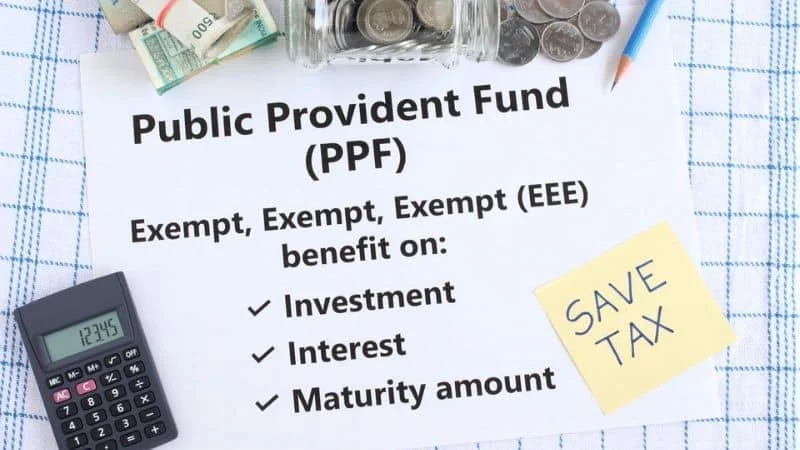

1. Tax Benefits of PPF

Navigating the world of taxes can be complex, but the Public Provident Fund (PPF) offers a clear path to savings. PPF provides a wonderful opportunity to reduce tax liability while earning interest, making it a popular choice among savvy investors.

Now, let’s explore the specifics:

1.1. Tax Exemption on Contributions to PPF

Your contributions to a PPF account are exempt from taxation. It’s like a financial gift from the government, allowing you to invest more of your income.

1.2. Tax-free Interest & Maturity Amount

The interest accrued and the final maturity amount in PPF are completely tax-free. This ensures that your savings grow without tax hurdles, maximizing your returns.

1.3. Comparing PPF With Other Tax-saving Instruments

While there are other ways to save on taxes, PPF stands out with its security and competitive interest rates. It’s like having a reliable financial partner that looks out for your best interests.

Embracing the benefits of PPF is a smart move for anyone seeking tax advantages and financial growth. It’s more than just a savings scheme; it’s a pathway to financial peace of mind.

2. Long-Term Wealth Creation

Building wealth is a journey, and PPF offers a roadmap to financial success. Its long-term nature and consistent returns make it a powerful tool for growing your assets.

Let’s delve into the details:

2.1. Power of Compounding in PPF

PPF allows your money to grow exponentially through compounding. It’s like planting and watching a seed grow into a mighty tree. Your money works for you, day and night, year after year.

2.2. Consistent Growth of Investments Over Time

With PPF, you don’t just save; you invest in your future. Its consistent growth ensures that your money isn’t just sitting idle but flourishing. Imagine a garden steadily blooming – that’s your PPF account.

2.3. Harnessing PPF for Long-Term Financial Goals

Whether buying a home or planning retirement, PPF can be your financial ally. It’s like having a dedicated co-pilot on your life’s financial journey, helping you reach your dreams.

In conclusion, the benefits of PPF in long-term wealth creation are substantial. It’s not just a savings account but a wise financial companion. If you want your money to work as hard as you do, PPF might be the perfect fit for you.

3. Guaranteed & Risk-Free Returns

Who wants to avoid safety and assurance with their hard-earned money? With PPF, you can enjoy a peaceful financial journey, knowing your savings are secure and growing steadily.

Here’s a closer look:

3.1. PPF as a Safe Investment Option

Think of PPF as a sturdy ship sailing through the turbulent financial seas. It’s designed to keep your investments safe, regardless of market storms. Your money is tucked away, growing slowly but surely.

3.2. Government-Backed Security & stability

With the government’s strong backing, PPF is like having a financial shield. It’s a fortress for your savings, ensuring stability and protection. It’s like having a guardian watching over your financial future.

3.3. Mitigating Risk With Assured Returns

Playing it safe doesn’t have to mean missing out on growth. PPF balances security with competitive returns. It’s a financial tightrope walker, gracefully balancing risk and reward for your benefit.

In wrapping up, the benefits of PPF extend far beyond just numbers. It’s about peace of mind, security, and a promise of growth without unnecessary risk. It’s like having a safe harbor in the unpredictable world of investments. If you value these qualities, PPF might be the perfect choice for you.

4. Retirement Planning With PPF

Imagining a retirement filled with comfort and leisure? PPF could be the friend guiding you down that path. It’s like planting a seed today and watching it grow into a mighty tree that shelters you in your golden years.

Here’s how:

4.1. Building a Retirement Corpus Through PPF

Think of PPF as a virtual piggy bank. Every deposit you make is a step towards a secure future. With the compounding magic, your small savings blossom into a substantial fund ready to greet you at retirement.

4.2. Utilizing PPF as a Long-Term Savings Tool

PPF isn’t just a savings account; it’s a retirement partner. With a lock-in period of 15 years and the option to extend, it’s like a financial companion, growing with you and for you, making sure you have a financial cushion when you need it.

4.3. Factors to Consider for Retirement Planning Using PPF

Planning with PPF isn’t a one-size-fits-all game. Consider your age, goals, risk tolerance, and expected retirement lifestyle. It’s like tailoring a suit; it must fit you perfectly to look and feel great.

In sum, the benefits of PPF for retirement planning are like a dependable friend who sticks with you through thick and thin. It’s about building a future where money isn’t a worry, so you can focus on enjoying life’s finer moments.

5. Flexibility & Liquidity

Who said saving for the future means locking away your money out of reach? With PPF, it’s like having your cake and eating it too. It’s a savvy financial tool that maximizes long-term savings with the wiggle room for life’s unpredictability.

5.1. Partial Withdrawal Facility From PP

Imagine a treasure chest that lets you take out some jewels occasionally. With PPF, after the 7th year, you can make partial withdrawals. It’s a friendly financial pat when you need a little extra.

5.2. Loan Facility Against PPF Balance

Need a loan? Your PPF account waves hello! From the 3rd year onwards, you can borrow against your PPF balance. It’s like having a financial buddy that lends you an umbrella on a rainy day.

5.3. Balancing liquidity Needs With Long-Term Goals

Think of PPF as a financial dance partner, gracefully moving with your life’s rhythm. It helps you save for the future but understand when to dip into those savings.

In conclusion, the benefits of PPF aren’t just about stashing away money for a distant tomorrow. It’s about having a flexible friend who walks with you, step by step, accommodating your needs and ensuring that your future is bright and your present is cared for.

6. Financial Discipline & Regular Savings

Think of PPF as a wise old friend who gently nudges you toward good habits. It’s like a personal trainer for your wallet, helping you build financial muscles that last a lifetime.

Here’s why:

6.1. Cultivating a Savings Habit With PPF

Remember your childhood piggy bank? PPF is the grown-up version. It coaxes you to save, gradually turning a daunting task into a fun routine. It’s a friendly nudge towards becoming a savings champion.

6.2. Mandatory Annual Contributions For Account Continuity

This isn’t a pushy rule; it’s a clever motivation. By requiring a small annual deposit, PPF ensures you stay on track. It’s like having a gym buddy who insists on regular workouts keeping your finances fit and trim.

6.3. Discipline as a Key to Financial Well-being

Have you ever heard the saying, “Slow and steady wins the race?” PPF embodies that wisdom. Encouraging steady saving, teaches the art of financial discipline. It’s a life skill that’s more valuable than gold.

So, the benefits of PPF aren’t just numbers and interest rates. It’s about learning, growing, and becoming financially wise. It’s about having a dependable ally that helps you sculpt a financially secure future, one deposit at a time.

7. Education & Future Planning Benefits of PPF

Imagine PPF as a nurturing tree. You plant the seed today, and it grows, providing shade and fruits for future generations. How so? Let’s delve into:

7.1. Utilizing PPF For Children’s Education Expenses

When your kids are ready to take on the world, PPF will be right there with you, supporting their dreams. Like a wise family friend, it assists you in affording quality education without breaking the bank.

7.2. Creating a Financial Safety Net For Future Needs

Sometimes life throws curveballs. PPF is like a comforting blanket, offering financial safety when needed. It’s not just about money; it’s about peace of mind and knowing you have a backup.

7.3. PPF’s Role in Comprehensive Financial Planning

Think of PPF as the backbone of your financial plan. It supports and aligns with your long-term goals, from buying a home to retiring gracefully. It’s a partnership that stands the test of time.

The benefits of PPF go beyond savings and taxes; it’s about carving a path that supports your family’s dreams and aspirations. It’s like having a financial friend who understands your hopes, shares your vision, and walks beside you every step of the way.

8. Estate Planning & Wealth Transfer

Now, I want you to picture your hard-earned wealth as a beautiful legacy, a heritage that you pass down through generations. PPF can be the golden key in this process. Let’s explore how:

8.1. PPF As Estate Planning Tool

Think of PPF as a wise guide helping you craft a plan that ensures your assets reach the right hands. It’s more than an account; it’s a bridge to your loved ones’ future.

8.2. Nominations & Succession Planning For PPF Account

PPF allows you to designate your loved ones, ensuring they benefit from your savings without legal hurdles. It’s like leaving a roadmap for them, clear and easy to follow.

8.3. Ensuring Smooth Wealth Transfer To Beneficiaries

PPF ensures that your wealth flows like a gentle stream into the hands of those you cherish. No storms, no disruptions, just a seamless transition that reflects your care and foresight.

The benefits of PPF in estate planning are like a skilled artist’s brush, painting a future that resonates with your wishes and love. It’s about ensuring your hard work continues to support and bless those dear to you, even when you’re not around to guide them.

9. Protection Against Inflation – Protect Benefits of PPF

Imagine inflation as a pesky monster trying to steal your hard-earned money. Now, picture PPF as a shield, keeping that monster at bay. Let’s dive into how:

9.1. PPF’s Potential To Combat Inflation

You know that monster I mentioned? PPF knows how to deal with it. With stable interest rates often exceeding inflation, PPF turns your savings into a fortress, standing tall against the inflation monster’s attacks.

9.2. Maintaining Purchasing Power With PPF Investments

PPF’s interest rates are like magic potions that help your money grow stronger. Even as prices rise, your PPF investment ensures you can still afford the things you love. It’s like having a magic wallet that always has what you need.

9.3. Inflation-Adjusted Returns with PPF

The beauty of PPF is that it’s not just standing still. It’s actively fighting for you, adjusting to inflation’s twists and turns. It’s like having a smart financial friend who’s always one step ahead, ensuring your returns aren’t left behind.

The benefits of PPF in battling inflation are like having a financial superhero in your corner. It’s not just about saving money; it’s about making your money work for you, keeping you safe, secure, and empowered in an ever-changing financial landscape.

10. Capital Preservation & Risk Management

Imagine your money as a delicate treasure and the benefits of PPF as a protective casing around it. Here’s how it works:

10.1. Shielding Investments From Market Volatility

Markets can be wild and unpredictable, like a stormy sea. PPF is like a sturdy ship that sails smoothly through those stormy waters, keeping your treasure safe and dry. How comforting is that?

10.2. Diversification Benefits Of PPF in a Portfolio

Think of PPF as a secret ingredient in your financial recipe. Mixing it with other investments creates a balanced dish that tastes just right. It’s the financial seasoning that brings harmony to your portfolio.

10.3. Hedging Against Economic Uncertainties

Life and the economy throw curveballs. PPF is like a trusty glove that catches those curveballs for you. It’s a dependable financial player, always ready to step in when things get shaky.

In a world filled with financial twists and turns, the benefits of PPF provide a comforting embrace. It’s like having a wise financial guide who knows the way, shields you from dangers, and ensures your treasure grows safe and sound. It’s not just about saving; it’s about thriving with peace of mind.

Conclusion – Benefits of PPF

The Public Provident Fund (PPF) is a standout financial instrument in India, offering numerous advantages. It provides tax-free returns, promotes disciplined savings, and ensures the safety of your investment with government backing. The extended lock-in period encourages long-term wealth creation, and the option for loans and partial withdrawals adds flexibility. PPF is not just an investment but a commitment to securing a prosperous future, making it a valuable addition to any financial portfolio.

- Benefits of SAP (2024) – Business And Finance Benefits - March 14, 2024

- Benefits of PPF (Public Provident Fund) – Benefits for Financial Future In 2024 - February 23, 2024

- Benefits Of Auditing (2024) – Streamline Your Operations & Compliance - February 22, 2024